Sponsored Content by PatSnapReviewed by Emily MageeJan 10 2023

More than 722 million wearable devices in 2019 were in use globally, and it is anticipated that this figure will reach one billion by the end of the year. Wearable electronics are altering everyday life, from smart jewelry and apparel to fitness monitors and body sensors that monitor health and well-being.

Wearable medical devices are particularly revolutionary. These devices help make its user more proactive with regard to their well-being whilst also enabling doctors to monitor their patients remotely.

This industry is full of promise, so much so major IT firms are racing to patent their wearable device intellectual property (IP). Huge companies like Microsoft, Apple, and Samsung compete to provide their consumers with the most cutting-edge products.

This article seeks to discuss the trends in IP and innovation that are impacting the future of wearable technology. These topics include:

- Patent application and grant trends

- Key players and emerging entrants

- Investment activity across the industry

The charts and graphs used throughout this article were sourced from PatSnap’s Al-powered innovation intelligence platforms, which include Discovery, Analytics and Insights.

To help connect the dots, these systems collect diverse data from patent applications, issued patents, mergers, technology headlines, acquisitions, and venture capital investments.

These insights were used in combination with the findings of reputable sources to create a thorough 360-degree overview of where the industry stands today and where it is going.

Introduction

Smart devices, otherwise called wearable devices, are designed to be worn close to the skin on the body. Jewelry and smart apparel are some examples of said devices. These devices have been intentionally designed to collect and monitor data from daily activities over a quantified period.

Approximately 30% of adults in the United States use wearable electronics to track their health and well-being. Wearable devices have an impact on the healthcare sector in numerous ways, including heart rate and blood pressure monitoring, daily step tracking, fitness reminders, and sleep pattern analysis.

This raises an important question concerning how wearable technology affects healthcare providers and patients.

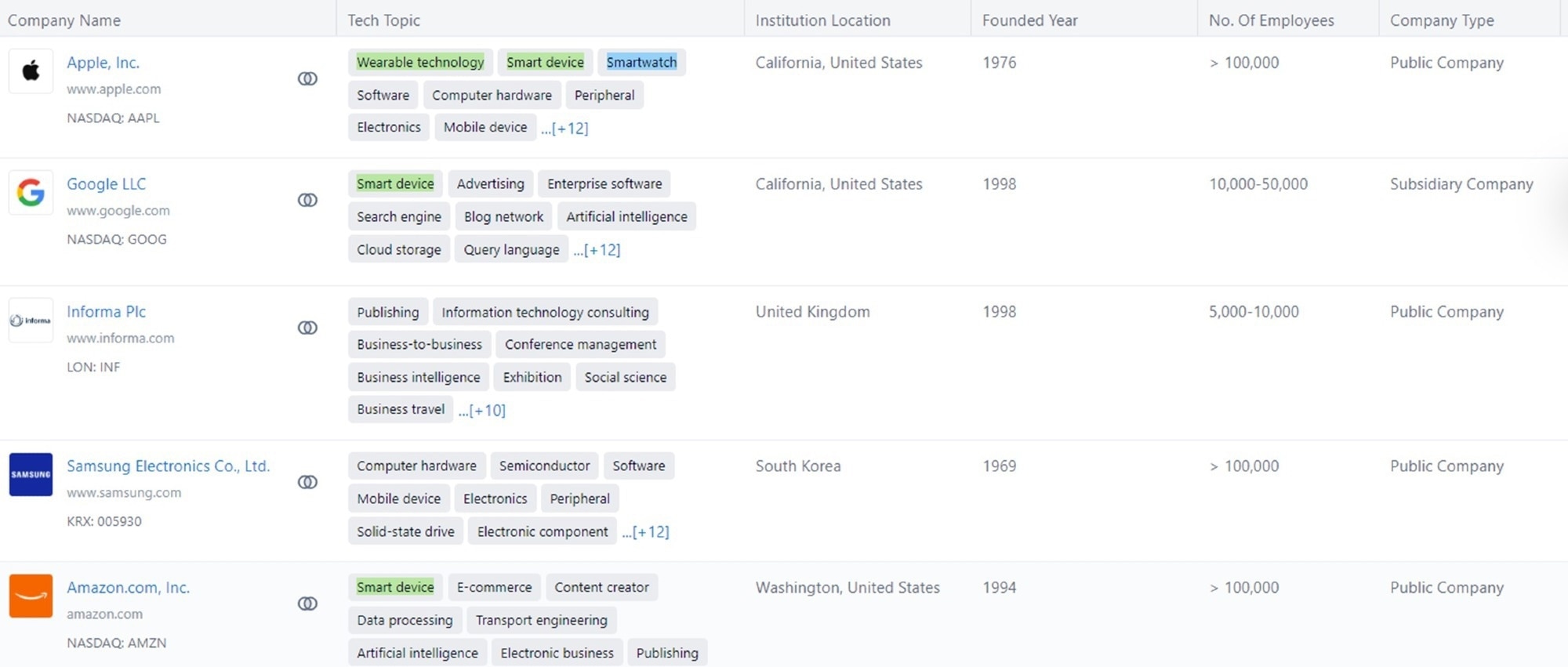

The wearable technology market was valued at over $115.8 billion in 2021, as per a recent study, and by 2028, it is projected to reach a valuation of $380.5 billion. Apple, Samsung, Google, Amazon, and Informa are among the worlds leading companies for wearable technology.

Image Credit: PatSnap

A landscape overview of wearable medical devices

When analyzing IP in the wearable medical technology sector, many factors must be considered, such as:

- Patent legislation as it links with hardware developments (physical product attributes)

- The capabilities of current medical device technology

- Software developments (the technology behind the product)

For companies trying to innovate and succeed in this industry, a targeted patent search is crucial. This method minimizes the risk of potential infringement while enabling companies to authenticate concepts and identify potential opportunities.

Difficulties associated with patenting wearable medical technology

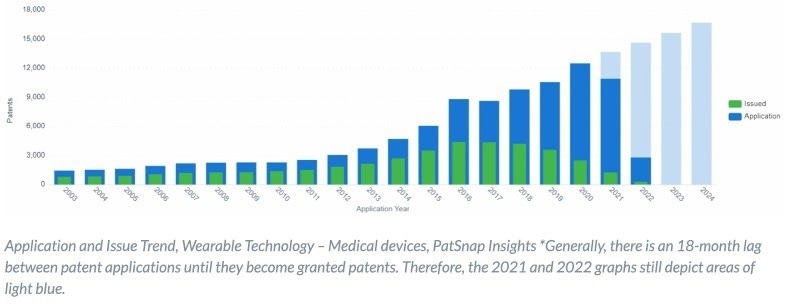

Patent trends in the healthcare industry are depicted in the graph below as they relate to wearable technologies. Granted patents are represented by green lines, patent applications are represented by dark blue lines, and projected future application trends are identified via the light blue lines.

Image Credit: PatSnap

The number of wearable device patent applications has been consistently on the rise since 2016. However, the industry is still in its early stages, trying to work through the creases, including the jurisdictional laws that are associated with patentability.

According to European law, wearable devices that come under “digital health” can be patented as traditional medical devices. However, acquiring software-based patents in Europe is riddled with obstacles.

For instance, patentable software must have a “technical effect.” Therefore, updating the software for a wearable medical device that captures sensor data at unpredicted periods can render the device patentable.

The healthcare sector and associated innovations consider numerous medical exclusions, such as surgeries to treat human or animal bodies, therapy, or other diagnostic operations. This is because these methods cannot be patented.

Companies can bypass these restrictions by changing their patent requirements and connecting them to particular medical uses rather than therapeutic techniques.

Patent laws regarding “digital health” are distinct in the United States. The Supreme Court has ruled that only “inventive ideas” can be patented. According to the Supreme Court, digital health inventions fall within the category of “abstract concepts”.

In one case, the Court of Appeals for the Federal Circuit ruled that a patent for a system that allows medical experts to connect with real-time patients and transmit health information could not be granted because it is an abstract concept. Regardless, abstract ideas having inventive notions can be patented. To be successful, innovators must emphasize the technological advancement or practical usage of the idea in question.

From the preliminary phase to the approval stage, getting a patent can take as long as two years. The US Food and Drug Administration’s (FDA) approval process further complicates the procedure. Companies also need to obtain approval from regulatory authorities like the FDS and patent agencies to protect and market their products.

Under the Hatch-Waxman Agreement, organizations can request a patent term extension to mitigate infringement issues during this time. When the patent holder cannot use their patent rights due to FDA restrictions, the patent term is extended by up to five years.

The patent term extension request must be filled to the United States Patent Trade Office (USPTO) within sixty days after the FDA product application date.

Wearable medical devices: Patent landscape

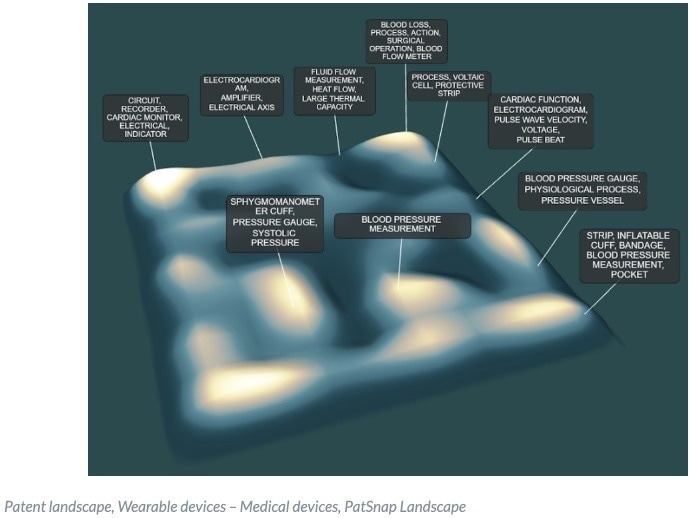

Image Credit: PatSnap

The above image depicts the current landscape of wearable devices in the medical sector. Based on the peaks and troughs, this terrain indicates where patent activity is low and high.

It is a good idea to analyze low points in the market for possible opportunities, as these points suggest future hot spots where companies will invade the market.

As the graph below demonstrates, blood pressure and cardiac wearable devices remain crucial for many companies. This makes sense, given that sensor technology already exists, making it simpler for companies to innovate and make modest adjustments without reinventing the proverbial wheel.

Additionally, the availability of manufacturers facilitates the transition of an idea from concept to commercialization.

Apple aims to add more improvements to the Apple watch to enhance its capacity to measure cardiovascular health. These improvements will enable customers to monitor their blood pressure – which will be a potentially lifesaving function. High blood pressure threatens 108 million individuals in the United States alone and causes more than 500,000 fatalities annually.

The procedure of implementing these upgrades is not easy. The FDA’s authorization is a precondition for any such enhancement, which can take several years. However, even if these upgrades are executed, they may not have the expected results.

Smartwatches retail at $100 to $400, and the customers that would gain the most benefit from these improved capabilities are mostly low-income households.

To impact the healthcare sector, particularly early disease detection, governments, insurance companies, and private firms must collaborate to make these devices just as accessible as medications to those who need them the most.

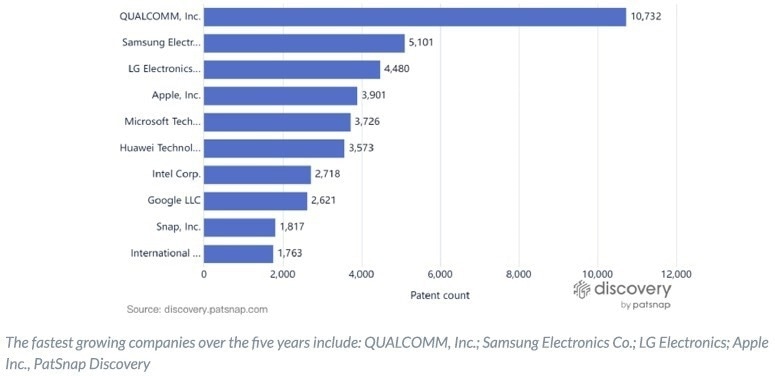

Image Credit: PatSnap

Image Credit: PatSnap.

Key wearable device patents

As the number of granted patents increases, so will funding for startup companies and technology-based mergers and acquisitions (M&A).

Utilizing a set of electronically available data, PatSnap’s indicator-based patent value approach eliminates and neutralizes vendor or buyer bias. It considers more than 80 indicators, carefully selected by merging PatSnap’s internal research and expertise with external research sources.

Several crucial elements, such as financial worth, technical strength, market potential, strategic value, and legal value, are assessed during the valuation process. The patent graph depicting the top five most valued patents in the wearable gadget market is shown above.

Intriguingly, the patent held by Medtronic is ranked fourth, behind the patent held by huge commercial firms like Sony, Microsoft, and Apple.

These companies are effectively migrating their technologies to adjacent sectors, resulting in valuations of $13,000,000 and more. Valuations aid strategic decisions and corporate direction, which are often advocated by IP/legal professionals and experts.

Several patents can be awarded a revenue-based monetary value. For example, patent rights that encourage the purchase of a certain product and charge a premium price will affect the patent’s overall value. However, this issue is not black-and-white.

Frequently, the worth of a patent is not directly proportional to its revenue but rather based on other factors, such as its ability to keep its rivals away.

Painting a comprehensive picture of the medical device wearable industry

As discussed in the previous section, bringing new devices to market is challenging in any industry, but it is extremely difficult in the healthcare sector. As a result, running a patent analysis alone is not adequate since the top filers are usually not the industry leaders.

Patent information must be supplemented with other leading indications such as technical news, investments, and market dynamics. These data points ensure that enterprises operating in the wearable device market can limit risks related to infringement and failures.

The next section of this article concentrates on innovative efforts for this reason.

Image Credit: PatSnap

Traditional “medical device” companies have difficulty competing with established tech giants in the wearable medical device market. Although this seems counterintuitive, it makes sense considering the prominence of medical device companies such as Johnson & Johnson MedTech and Medtronic.

Apple, LG Electronics, Samsung, Qualcomm, and other large firms have huge investments and the knowledge required to create the software and hardware for wearable MedTech devices.

Innovation is just one aspect. To protect and commercialize their ideas, these companies must also get approval from regulatory agencies such as the FDA and patent offices.

With competition rising daily and more money invested in research and development than ever before, many companies are collaborating through mergers and acquisitions (M&A). Mergers and acquisitions reduce costs while boosting effect and efficiency.

Softheon, Inc., a New York-based company that recently acquired NextHealth Technologies, is one such example.

NextHealth is an Al-powered, healthcare-based software-as-a-service (SaaS) analytics service. Its platform is designed to relieve the burden on healthcare professionals by allowing users to track their daily readings (such as heart rate and blood pressure).

Softheon’s go-to-market strategy is significantly strengthened by this merger. This strategy will also improve its engineering process, resulting in more competitive and robust products. By developing Al in health services, these two companies want to give more inexpensive healthcare solutions to vulnerable individuals while improving the quality of care.

Although this is only one example, it highlights why many firms operating within the wearable medical devices industry find mergers an attractive option.

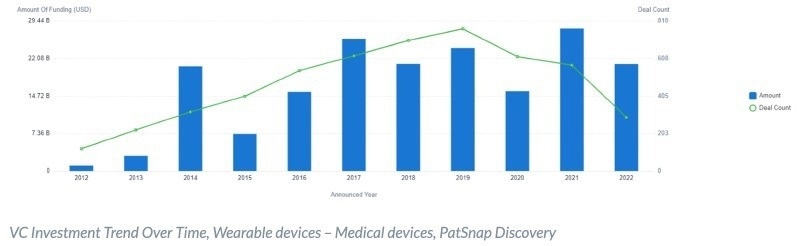

VC investment activity in the wearables sector

Image Credit: PatSnap

Wearable technology is attracting more investors as it continues to develop in popularity. This is particularly clear when looking at statistics from the last six years. There has been a noticeable increase in patent applications. The industry is not expected to slow down any time soon, with a CAGR of 13.67% projected between now and 2027.

It is anticipated that the need for wearable medical devices will rise as the population ages, especially as chronic illnesses such as diabetes and heart disease become more prevalent.

According to the World Health Organization (WHO), chronic diseases claim the lives of an estimated 41 million people each year. Physical fitness and good eating habits are important in countering many of the negative externalities associated with these conditions.

Wearable devices make it simpler for patients to track their physical activity and food intake and share the data with healthcare professionals, often in real time. Since there is no lack of prospective clients, these market insights make the wearable medical device sector a desirable venture for many investors.

Another appealing feature for investors is the regulatory approvals in certain jurisdictions, such as those in the United States. For instance, the FDA approved Biobeat’s remote patient monitoring device in March 2022. This device monitors respiratory rate, body temperature, cuffless blood pressure, blood oxygen levels, and pulse rate.

Biobeat was granted 510(k) clearance for this wearable device, indicating that the FDA approved it as “effective, safe, and substantially comparable to a legally-marketed device.” Submitting a 510(k) permits medical device companies like Biobeat to release new products without undergoing clinical studies or testing, saving time and money.

Closing comments

There is little doubt that wearable medical devices are reshaping the healthcare industry. It is anticipated that wearable devices will continue to develop, from smart watches and jewelry to clothing and beyond, particularly as the population ages and people become more empowered with their self-care practices.

Companies must be persistent and smart in their IP protection strategies and applications. This decreases the chance of infringements and increases the likelihood of both short-term and long-term success.

To use these insights to make informed business decisions, companies will need to closely monitor and analyze patent behavior and development trends.

PatSnap’s Al-powered innovation intelligence platform, Discovery, can be used to understand more about trends influencing wearable medical devices and other IP or innovation trends.

The subscription is free, providing instant access to billions of global data points on investment activity, academic publications, technological news, and patents.

Image Credit: PatSnap

PatSnap assumes no responsibility for the accuracy of data and information obtained from patent authorities and Commercial Databases. PatSnap and its affiliates hereby explicitly disclaim any liability or responsibility for the accuracy, completeness, or usefulness of any information and opinions included in this report.

Any decisions or actions taken by any party based in any way whatsoever on the contents of this report are solely the responsibility of that party. In no event shall PatSnap or its affiliates be liable for any losses, damages, claims, liability, costs, or expense (including legal expenses) or consequential or indirect financial loss or loss of profit, loss of earnings or revenue, loss of use, loss of contract or loss of goodwill arising from the publication and use of this report to the fullest extent permissible by law.

About PatSnap

As the global leaders in connected innovation intelligence, we use AI-powered and machine learning technology to comb through billions of datasets, and help innovators connect the dots. With a team of more than 800 PatSnappers spanning three continents, and 10,000+ customers in 40+ countries, we are revolutionizing the innovation process and making it faster, more efficient, and easier than ever before.

Sponsored Content Policy: News-Medical.net publishes articles and related content that may be derived from sources where we have existing commercial relationships, provided such content adds value to the core editorial ethos of News-Medical.Net which is to educate and inform site visitors interested in medical research, science, medical devices and treatments.