Compared to other high-income countries, Switzerland actually spends the most on out-of-pocket healthcare when compared to the average income, new research shows.

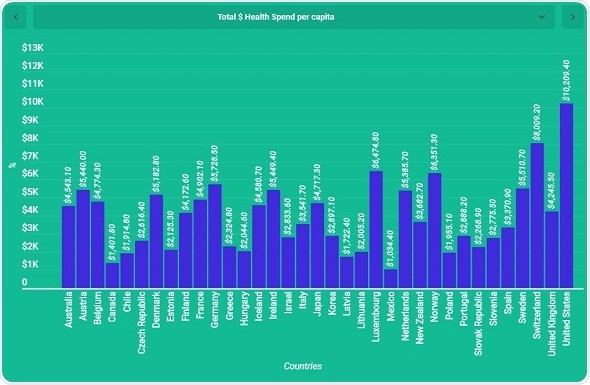

With an average annual salary equivalent of $62,283 and total voluntary/out-of-pocket health spending of $5,291.73, the Swiss are spending 8.5% of their income on healthcare per year, according to Organisation for Economic Co-operation and Development (OECD) data.

In comparison, the US spends 4.8% of each citizens’ $60,558 average annual salary on voluntary and out-of-pocket healthcare - despite being the only OECD country where government spending and compulsory health insurance isn’t the primary source of health financing.

It comes to light after new research has been published by antibody supplier and medical research specialist Antibodies.com, which compares global healthcare and pharmaceutical spend against annual salaries.

The research also reveals that an annual supply of six of the top-selling prescriptions costs an average of $5,377.44 more to buy in the US than in the UK, with Americans expected to pay out almost half of their annual salary on a year’s supply of Humira rheumatoid arthritis injections alone - even after monthly discounts.

Insulin, despite urgent calls for a price reduction, remains more expensive to purchase in the US than anywhere else, with diabetics facing annual costs of up to $10,404 for life-saving supplies of Novolog. This has predictably led to some Type 1 sufferers being forced to ration their rapid-acting insulin injections, causing blood sugar levels to reach fatal lows.

While the lack of uniform healthcare system in the US means that many end up paying extortionate fees for essential medication, fixed prescription charges in the UK mean that medicines are generally more affordable and accessible than in other industrialized countries.

However, the NHS is struggling to cope with increasing demand on services, staff shortages and lack of financing, despite the government’s long-term funding plan to provide it with an additional £20.5 billion ($27.3 billion) by 2023-24.

The analysis shows that this extra funding won’t be enough; the NHS needs a further £12.1 billion ($16.1 billion) to maintain current provisions, and £21.3 billion ($28.4 billion) to improve services. If this funding gap is met through taxes, the average UK household would need to pay an additional £340 ($453) a year through income tax, NICs and VAT to improve the NHS, or £150 ($200) just to maintain it.

Antibodies.com managing director Stewart Newlove said:

Although the NHS is an essential element of UK healthcare there is, without a doubt, some difficult financial decisions to be made when it comes to maintaining the current quality of care or improving provisions.

This research reinforces the importance of financing the NHS by whatever means necessary, as there’s a clear connection between the amount of government or compulsory healthcare funding and better access to - and affordability of - essential medicines.

However, rising healthcare costs need to be met with a matched national living wage, otherwise people will be forced to choose between seeking treatment for life-threatening conditions or putting food on the table.”

To see the results of Antibodies.com’s Cost of Living (and Staying Alive) analysis, visit https://www.antibodies.com/cost-of-saving-life-us/