Most new medicines have come from research conducted by for-profit pharmaceuticals, especially the large firms – a whopping 73% of all approved drugs come from the top 25 drug companies in the US. While such companies need to maintain adequate profit margins to satisfy their stockholders, they should also ensure that patients can afford their medicines.

Most people think that drug prices are high because of the high-profit margins. The current study was motivated by the need for evidence as to the actual profitability of the companies making most of the drugs in the country.

The study

Many pharmaceutical companies adopt the following drug pricing strategy:

- boost list prices

- discount drugs to compensate for a part of the increase

- position new drugs strategically by reducing prices of other possibly competing drugs, thus reducing the competition and increasing the market share

- increase sales volume

However, patients get none of the discounts, and insurance co-payments are calculated based on the list price.

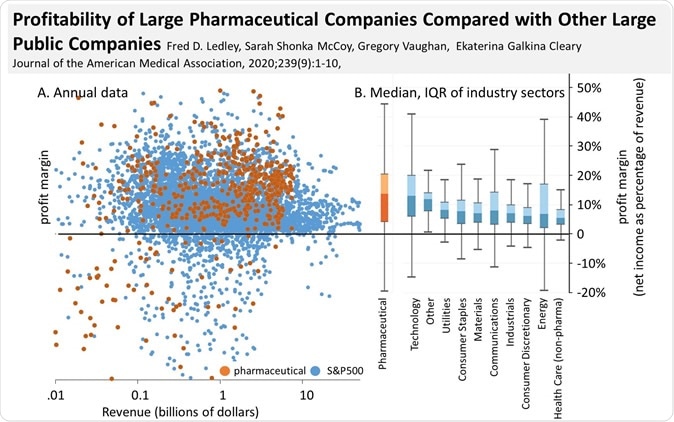

The researchers conducted a cross-sectional study of 35 large pharma companies. The aim was to compare their profits with that of almost 360 companies in the Standard & Poor 500 (S&P 500) Index from 2000 to 2018. The latter did not include companies specializing in financial development. They did include companies dealing with staple consumer items, materials and industrial equipment, and healthcare products, as well as technology, utilities, communications, and energy sectors. The data was retrieved from the annual reports.

A study from the Center for Integration of Science and Industry at Bentley University compares the annual profits of 35 pharmaceutical companies to 357 D&P 500 companies. The net income margin of pharmaceutical companies was larger than that of S&P 500 companies (median 13.8% vs 7.7%, p<.001) but similar to companies in certain industrial sectors. Image Credit: Bentley University

The outcomes assessed included revenue, gross profit (that is, revenue less cost of goods sold); earnings before interest, taxes, depreciation, and amortization (EBITDA) which represents the profit from the core business activities before taxes; and net income, or earnings (difference between the sum of revenues and the sum of expenses).

The researchers calculated the cumulative profit or the annual profit as a percentage of the revenue (the profit margin).

The findings

Both sets of companies had similar median annual revenues of $10.6 billion vs. $8.4 billion for pharma and other companies. The cumulative revenue from the large pharmaceutical companies over the study period was $11.5 trillion. The gross profit was $8.6 trillion, while the EBITDA was $3.7 trillion. The net income was $1.9 trillion.

In comparison, the 357 S&P 500 companies had a cumulative revenue of $130.5 trillion, with a gross profit of $42.1 trillion, EBITDA of $22.8 trillion, and net income of $9.4 trillion. The net income margin and the median EBITDA was higher for pharmaceuticals compared to most of the other companies, including those in the healthcare sector, except for technology and ‘other’ sectors.

While the goods sold were less expensive for the pharmaceutical companies, they also spent more on research and development expenses (claimed to be anywhere between $985 million and $ 2.9 billion per new drug) as well as general and administrative expenses, as a percentage of revenue.

The median annual gross profit margins were markedly higher for the big pharma companies compared to other companies. However, the latter includes technology giants Amazon, Apple, Microsoft, and Google’s Alphabet, all of which have made successful forays into healthcare, returning high-profit margins.

The split up is as follows, for pharmaceutical and other firms:

- gross profit margin approximately 77% and 37%

- EBITDA margin: 29.4%vs 19%

- net income margin: 13.8% vs 7.7%

In other words, the median net income margin for the large pharma companies is nearly double that of the other companies. However, Alphabet, Apple, and Microsoft have net profit margins of 22%, 20%, and 28%, respectively

After adjusting for the size of the company and the year of calculation, and for companies that reported the expenditure on research and development, the gross profit margin continued to be higher, with a difference of 31% approximately between pharma and other companies (unadjusted difference, 39%), and a difference of 9% and 4% compared to the earlier 10% and 6% in the EBITDA and net income margins, respectively.

Implications

The study highlights the higher profitability of large, fully integrated pharmaceutical companies compared to other companies in the S &P 500 Index in the study period. The most marked difference was in the gross profit margin, but the EBITDA margin is also more significant for pharma companies. Accounting for interest payments, taxes, and other expenses, the net income margin was also significantly higher. This is the company’s bottom line.

However, the analytic results vary with time, company size, and whether research and development expenses are reported for both datasets. Profits went down for large pharmaceutical firms over the last five years, but it is not clear if this is a significant change.

Drug prices do not directly reflect the list price (wholesale acquisition price) but are affected by the chain of distribution. The drug market in the US also accounts for much more of the global revenue from any given drug than the actual 47% of sales volume that it is responsible for.

The study did not include smaller firms that are conducting research, often under loss conditions, into novel therapeutic avenues. Thus, this does not mean that all pharmaceuticals are hugely profitable.

Many federal lawmakers have proposed various measures to establish ceilings for drug prices in the US. These include:

- importing drugs from Canada

- capping drug payments when they reach 120% of average drug prices in other countries

- setting a limit for out-of-pocket medication expenditure for older people at $2,000

- prohibiting pay-for-delay deals - payments from branded medication manufacturers to generic biosimilar manufacturers to keep the latter out of the market and sustain their monopoly

- disclosing list prices in advertisements of drugs.

Unfortunately, most have met with opposition and are unlikely to be passed.

Given the extreme and, in the opinion of many experts, unjustifiable, increase in drug prices, class-action lawsuits have been filed against certain large manufacturers, including the company that produces the world’s number one selling drug. These legal challenges are often filed by the consumers who have to pay for the drugs, occurring when lawmakers seem to be either unwilling or unable to push through legislative measures to ensure fair drug pricing. This may mark a new era of a consumer-powered setting of drug prices.

Journal reference:

Ledley FD, McCoy SS, Vaughan G, Cleary EG. Profitability of Large Pharmaceutical Companies Compared With Other Large Public Companies. JAMA. 2020;323(9):834–843. doi:10.1001/jama.2020.0442